Yes Bank shares surge post Q4 results. Should you buy, sell or hold?

Yes Bank’s shares jumped more than 5% in BSE in the opening offer on Monday after the bank on Saturday posted a Q4 net profit of ₹ 367 Crore, compared to losses ₹ 3,788 Crore in the March quarter from the previous financial year.

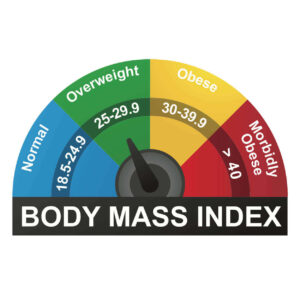

Non-Performing Assets Dirty (NPA) as a percentage of total progress reaching 13.9% on March 31, down 150 Basis Points (BPS) Y-O-Y and 80 BPS lower than the previous quarter.The core income of the bank’s core core reached ₹ 1,819 crore for the March quarter, which was an increase of 84% when compared to last year’s period. Net interest margins are expanded to 2.5%, while recording loan growth of 8%.

The calm bank returns ratio, coupled with an interesting assessment of the large banks, makes it difficult to create a profitable case for YES Bank today, the analysts said in Nirmal Bang. The broker has maintained its selling ranking on YES Bank shares with a target price (TP) of ₹ 12.8. “The bank has guided to (1) 3% out of the NIM quarter at FY23 (2) 2.4% OPEX/Assets (3) 2% slip (4)> 0.75% ROA in FY23. Our number is quite low from management guidelines, but, we will watch quarterly shipments carefully to make changes to our estimates, “said the broker’s notes.Meanwhile, the private sector lender plans to establish an asset reconstruction company on track and hope to transfer all its bad loans to the entity at the end of June.

“We are still aware of the risk of late stress collection resolution, exposure to a net labeled 5.3%, ROE’s profile is simple during the transition and supply of overhang after the end of the stock locked. We maintain detention with an unchanged target price of ₹ 14,” said Icici Securities In a note at Yes Bank.